With the modern lifestyle comes unpredictability in financial matters. This could be due to a medical procedure, emergency repairs of the house among other sudden expenses which can usually require fast access to cash. In the UAE, such cases are not uncommon where there is a need for instant cash loans. This article will explore the definition of instant cash loans, their mechanics and different factors surrounding their applications.

An instant cash loan refers to a specific category of these personal loans which aims at enabling borrowers to get the advanced money quickly, particularly devoid of the tiresome application and approval processes of conventional loans. These types of loans take minutes for loan approval, and transfer of such loans is mostly on the same day. Usually these loans are unsecured which means no collateral is demanded.

Considerable numbers of instant cash loans also possess attractive characteristics that explain their popularity among the customers. One of the most important of these benefits is the quick approval process; so many of the lenders will allow the customer to fill an application form within some minutes, with most customers getting positive application responses almost immediately. Also, instant cash loans are easy to take since they can provide minimal requirements to be satisfied by the borrowers before applying for the loan. This includes easy staggering of the borrowing amount, where a borrower is allowed to indicate the amount they want to take up to the maximum limit set by the lender. After approval of the funds, the disbursement is fast, most cases on the same day, thus helping those in need of instant cash.

While the eligibility criteria for instant cash loans may vary by lender, the following are the standard requirements that you can expect. Most lenders tend to stipulate a minimum income requirement for the borrowers and over the years. The minimum income limits that are quoted range between AED 3,000 to AED 5,000. It is also the case that applicants are usually required to be above the age of 21 years, be either citizens of the UAE or non-citizens irrespective of having resident permits as it will come to play in the loans. Usually, employment verification is mandatory and in some cases, lenders may indicate the number of years one has worked with the current employer.

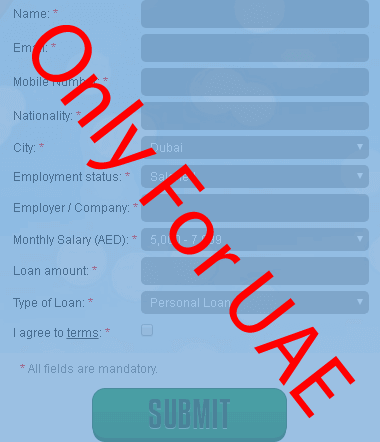

Usually, applying for an instant cash loan is as easy as it gets. First, you’ll need to research lenders to compare different financial institutions and find the best terms and rates for instant cash loans. Most of the lenders have online websites where you are able to fill in the application within minutes. Upon filling in the application form, you will be requested to submit additional documents which include copies of your Emirates ID, proof of income such as salary certificate and bank statements. As soon as you turn your application in, lenders will carefully consider your facts, and may even provide you with an answer almost right away. Upon approval, the money will be deposited in your account, typically after a few hours or the following business day.

The interest rates on instant cash loans differ from one lender to the other and are also affected by the borrower’s credit profile. Most often, these types of loans are more costly than traditional personal loans because there is less collateral involved and the processing time of such loans is shorter. Also, other charges tend to be attached to such loans such as administrative charges which are imposed for the convenience of the loans hence the ‘one-off’ payment term. Therefore borrowers should be aware that should they fail to make timely payments, extra fees can be charged for late payment, and if a borrower decides to pay off the entire loan before the due date a prepayment penalty may incur. Hence, it is imperative that one pays attention to the extreme details presented in the provided document in order to fully comprehend all the extra and concealed expenses.

Especially when there is no time to waste in sourcing for money, an instant cash loan is all that one may need. The foremost reason is that one is able to get the money within a very short period making the loans suitable for emergencies. Moreover, they are usually more convenient to opt for as one can make an application over the internet from the comfort of the home and no need to go to the office. Such loans also have a broader audience including the individuals with adverse credit ratings. Generally, personal use for which money from such a loan does not have restrictions and the borrower, for example, can spend on paying bills, on buying something really necessary, or investing in business, seeks to improve the management of the finances of the borrower.

Cash advance loans are beneficial, to an extent. However, it has its difficulties as well. One of the major drawbacks is the cost of borrowing; this type of money is primarily classified as short term unsecured loans hence maximum cost of borrowing is a norm as compared to a standard loan. Furthermore, the majority of the cash advances incorporate limited periods of loan usage, therefore the repayment terms per month are significantly high. The borrower also stands a chance of falling into the debt trap opposite to that of myself as there is a possibility of taking out more than one such loan for other expenses within a short span of time increasing the financial pressure.

Let us reiterate that one of the challenges of obtaining instant cash loans in the UAE is their excess. All in all, provided that these loans can be accessed with little bureaucracy and the money can be received fairly quickly, they would really serve their purpose of providing assistance in very challenging times. However, there is a need to consider the rates and charges as well so that healthy borrowing practices are exercised.

The Emirates Loan option is another case that can be provided in relation to the argumentative aspect of loans in UAE. This is due to the relatively lower rates and extensive types of services offered, Emirates Loan aims to help people in getting out of financial difficulties fast. In case you are rushing for a cash loan, or simply want to get consolidation of your existing obligations, Emirates Loan has the appropriate offers for you. Discover the competition and opportunities that the market has to offer you and your economy with your transcendent mind – and get the help that you are supposed to get with the help of Emirates Loan.